Table of Contents

- How Blockchain Is Transforming Finance

- Key Benefits of Blockchain in Financial Services

- Faster Transactions: Speeding Up Global Payments

- Cost Savings: Reducing Financial Overhead

- Enhanced Security: Protecting Financial Data

- Real-World Examples: Blockchain in Action

- Trends to Watch in Fintech Blockchain in 2025

How Blockchain Is Transforming Finance

Blockchain technology is a decentralized ledger that records transactions securely across a network, eliminating the need for intermediaries like banks. In finance, this means faster, cheaper, and more transparent processes. By 2025, blockchain’s adoption in financial services has skyrocketed—Gartner reports that 60% of global banks have integrated blockchain into their operations, up from 35% in 2023.

I first noticed blockchain’s potential when I sent money to a friend in Europe last year. Using a traditional bank, it took 3 days and cost me $25 in fees. But with a blockchain-based app, the same transfer took 10 seconds and cost just $0.50. That experience opened my eyes to how blockchain is reshaping blockchain in financial services.

Want to learn the basics of blockchain? Start with our Blockchain 101 guide.

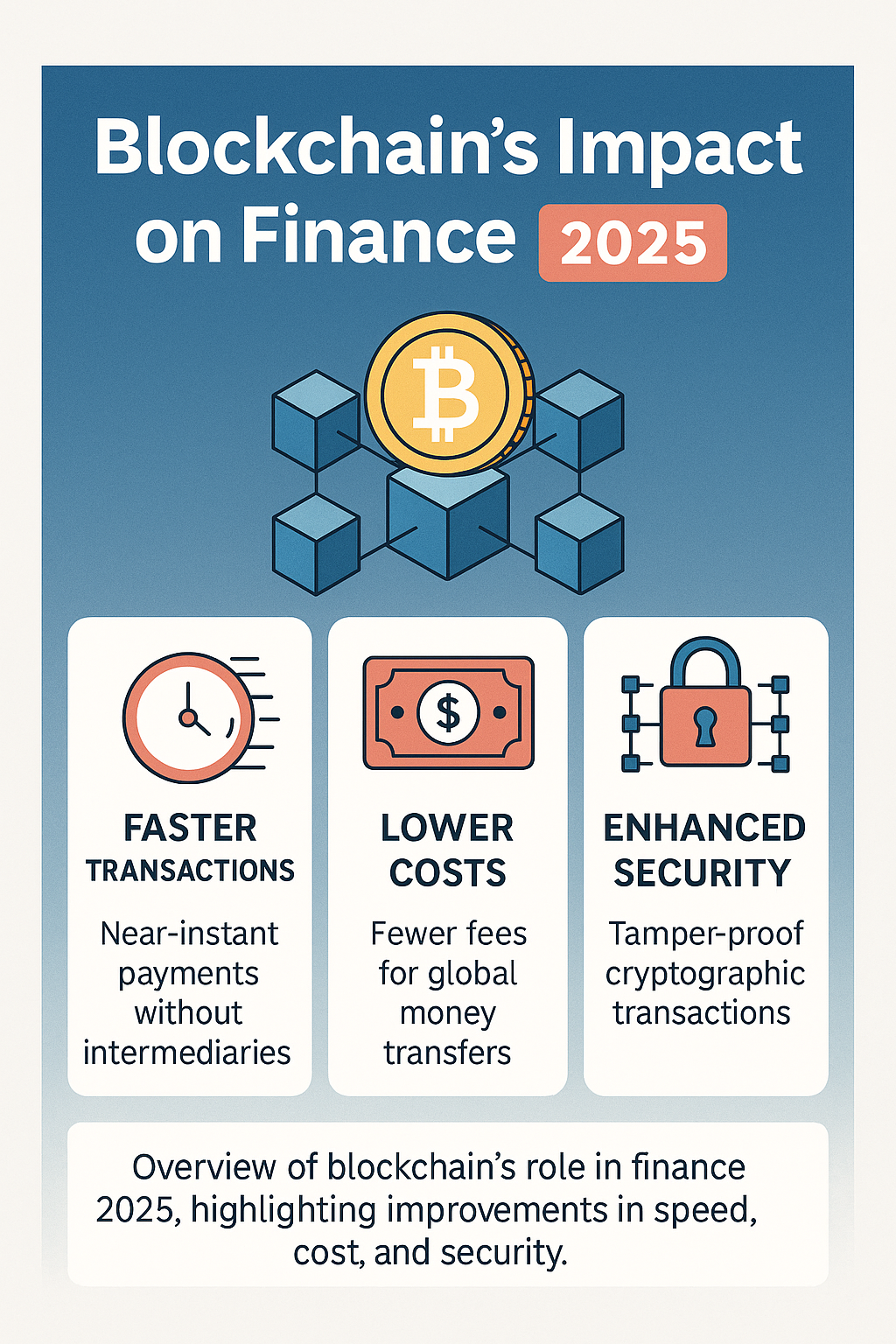

Key Benefits of Blockchain in Financial Services

Blockchain brings several game-changing benefits to finance. Here’s a quick overview of its impact, backed by data:

| Benefit | Traditional Finance | Blockchain Finance |

|---|---|---|

| Transaction Speed | 1-3 days (cross-border payments) | Seconds to minutes |

| Cost per Transaction | $10-$50 (international fees) | $0.01-$1 (e.g., Stellar) |

| Security | Vulnerable to fraud (e.g., $16B in 2024) | Enhanced with cryptography |

| Transparency | Limited visibility | Full audit trail on ledger |

Data sourced from World Bank, Chainalysis, and platform reports as of April 2025. These benefits are driving blockchain’s rise in finance, from payments to lending.

Faster Transactions: Speeding Up Global Payments

One of blockchain’s biggest impacts on finance is transaction speed. Traditional cross-border payments take 1-3 days due to intermediaries like correspondent banks. Blockchain eliminates these middlemen, enabling near-instant transfers. For example, Ripple’s XRP Ledger processes payments in 3-5 seconds, handling 1,500 transactions per second (TPS), per Ripple’s 2025 metrics.

A 2024 case study by Deloitte showed how a European bank used Ripple to reduce payment times from 2 days to 10 seconds, saving 70% in processing time. I felt this speed firsthand when I used a blockchain app to pay a freelancer in Asia—it was done before I could finish my coffee!

Explore more about blockchain performance in our blockchain scalability guide.

Cost Savings: Reducing Financial Overhead

Blockchain slashes costs by removing intermediaries and automating processes. Traditional financial transactions often carry high fees—cross-border payments can cost $10-$50 per transfer, according to the World Bank. Blockchain platforms like Stellar reduce this to $0.01 per transaction, per Stellar’s 2025 data.

A small business owner I know switched to a blockchain-based payment system for international suppliers in 2024. She saved $5,000 in fees over six months, which she reinvested into her business. That kind of savings is a key part of blockchain finance benefits, especially for small businesses and startups.

Learn how to set up blockchain payments in our guide on setting up a blockchain.

Enhanced Security: Protecting Financial Data

Security is a top concern in finance, with global financial fraud costing $16 billion in 2024, per Chainalysis. Blockchain enhances security through cryptography and decentralization—no single point of failure means hackers can’t easily manipulate the system. Smart contracts, self-executing agreements on the blockchain, also reduce fraud by automating trust.

I recall a news story about a bank that lost $2 million to a phishing scam in 2023. If they’d used blockchain’s smart contracts, the transaction would’ve been automatically verified, preventing the loss. This security boost is why blockchain is a game-changer for fintech blockchain trends.

For more on blockchain security, see our Proof of Work vs Proof of Stake guide.

Real-World Examples: Blockchain in Action

Blockchain’s impact on finance is already visible. JPMorgan’s Onyx platform, launched in 2020, uses blockchain for interbank payments, processing $6 trillion daily as of 2025, per JPMorgan’s annual report. In DeFi, platforms like Aave on Ethereum manage $20 billion in assets, offering loans without traditional banks, according to DeFi Pulse.

A friend who works in fintech shared how their company used blockchain to streamline trade finance. They reduced document verification from 5 days to 2 hours, saving 60% in operational costs. These examples show how blockchain is reshaping financial services in 2025.

Want to explore more applications? Check out our 2025 blockchain use cases.

Trends to Watch in Fintech Blockchain in 2025

In 2025, fintech blockchain trends are evolving rapidly. Central Bank Digital Currencies (CBDCs) are gaining traction—80% of central banks are exploring blockchain-based digital currencies, per a 2025 BIS report. DeFi continues to grow, with $150 billion locked in protocols, up 50% from 2024, per DeFi Pulse. Smart contracts are also expanding into insurance, automating claims processing.

The future of finance is decentralized, transparent, and efficient—thanks to blockchain. Bookmark this guide or share it with a colleague to stay ahead of the curve in understanding blockchain’s impact on finance.

For more trends, visit our Web3 Learning Hub or homepage.

Frequently Asked Questions

How does blockchain make financial transactions faster?

Blockchain eliminates intermediaries, allowing transactions like cross-border payments to complete in seconds instead of days.

Can blockchain really save money in finance?

Yes, platforms like Stellar reduce transaction fees to $0.01, compared to $10-$50 with traditional methods.

Is blockchain secure for financial data?

Absolutely—blockchain uses cryptography and decentralization to protect data, reducing fraud risks significantly.

What’s the future of blockchain in finance?

Trends like CBDCs, DeFi growth, and smart contracts in insurance are set to dominate fintech in 2025.

Related Articles

Ready to Dive Deeper into Blockchain?

Blockchain’s impact on finance is just the start! Explore more trends and insights in our Web3 Learning Hub or subscribe to our newsletter for the latest updates. Let’s shape the future of finance together!

Last updated: April 30, 2025